ACCA报名、考试、查分时间、免费短信提醒

ACCA报名、考试、查分时间、免费短信提醒

备考阶段

手机号

验证码

ACCA备考:MA(F2)吸收成本法和边际成本法的对比

2022-07-21

摘要今天帮主邀请来Yvonne老师为大家讲解Absorption costing和Marginal costing的区别,大家仔细听讲~ 今天来总结一下Management Accounting里面的一大重难点,吸收成本法(Absorption costing)和边际成本法(Margi

今天帮主邀请来Yvonne老师为大家讲解Absorption costing和Marginal costing的区别,大家仔细听讲~

今天来总结一下Management Accounting里面的一大重难点,吸收成本法(Absorption costing)和边际成本法(Marginal costing)两者之间的主要区别和联系。ACCA自学备考宝典:自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

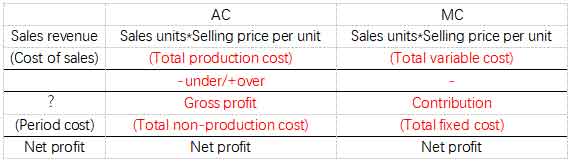

01.利润计算方法

文字解释:

文字解释:

①COS: 按销量计算,卖掉多少减多少。

吸收成本法下计入产品成本的只有total production cost(fixed production overhead & variable production overhead),当期销售出去的存货成本结转到利润表,即total production cost of sales;

边际成本法下计入产品成本的只有total variable cost(variable production overhead & variable non-production overhead),当期销售出去的存货成本结转到利润表,即total variable cost of sales。

②Under/over absorption:吸收成本法特有的,边际成本法不存在OAR和Under/over absorption。

涉及的计算公式:

Under/over absorption=Actual overhead-Absorbed overhead

Absorbed overhead=OAR*Actual activity level

OAR=Budget production overhead/Budget activity level

③Sales - COS:

吸收成本法下的主营业务收入-主营业务成本叫做Gross profit毛利润;

边际成本法下的主营业务收入-主营业务成本叫做Contribution贡献。

④Period cost:当期发生多少减多少。

吸收成本法下包含total non-production cost;

边际成本法下包含total fixed cost

⑤Valuation of closing inventory:Absorption costing > Marginal costing。

吸收成本法存货计价:Direct material+Direct labour+Variable production overhead+Fixedproduction overhead;

边际成本法存货计价:Direct material+Direct labour+Variable production overhead;

02.标准成本法中的差异

①Cost variance---fixed production overhead variance

Absorption costing:

A.fixed production overhead total variance=under/over absorbed overhead

B.fixed production overhead expenditure variance=budgeted overhead-actual overhead

C.fixed production overhead volume variance=budgeted units*OAR-actual units*OAR

D.fixed production overhead volume efficiency variance=(budgeted hours at actual output-actual hours)*standard production overhead per hour

E.fixed production overhead variance=(budgeted hours-actual hours)*standard production overhead per hour

Marginal costing:(因为MC法下不存在OAR,所以对于fixed production overhead variance只有expenditure variance)

fixed production overhead expenditure variance=budgeted overhead-actual overhead

②Sales variance---sales volume variance

Absorption costing:sales volume profit variance=(budgeted units-actual units)*standardprofit per units

Marginal costing:sales volume profit variance=(budgeted units-actual units)*standardcontribution per units

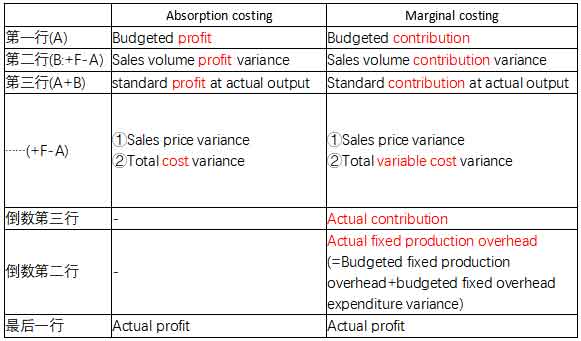

③Operating statement

03联系

利润差公式:MC+OAR*(closing inventory-opening inventory)=AC

注:1.此公式的利润指两种成本核算方法下的净利润,不是contribution和gross profit的比较;

2. Closing inventory-Opening inventory=Production units-Sales units

3. 此公式可以用于求OAR=(AC-MC)/(closing inventory-opening inventory)

以上便是吸收成本法(Absorption costing)和边际成本法(Marginal costing)之间的主要差异和联系了,你记住了吗~

今天来总结一下Management Accounting里面的一大重难点,吸收成本法(Absorption costing)和边际成本法(Marginal costing)两者之间的主要区别和联系。ACCA自学备考宝典:自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

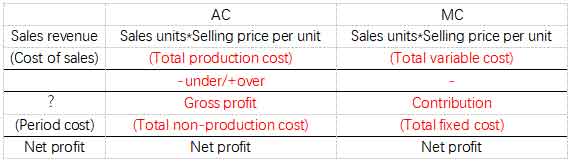

01.利润计算方法

①COS: 按销量计算,卖掉多少减多少。

吸收成本法下计入产品成本的只有total production cost(fixed production overhead & variable production overhead),当期销售出去的存货成本结转到利润表,即total production cost of sales;

边际成本法下计入产品成本的只有total variable cost(variable production overhead & variable non-production overhead),当期销售出去的存货成本结转到利润表,即total variable cost of sales。

②Under/over absorption:吸收成本法特有的,边际成本法不存在OAR和Under/over absorption。

涉及的计算公式:

Under/over absorption=Actual overhead-Absorbed overhead

Absorbed overhead=OAR*Actual activity level

OAR=Budget production overhead/Budget activity level

③Sales - COS:

吸收成本法下的主营业务收入-主营业务成本叫做Gross profit毛利润;

边际成本法下的主营业务收入-主营业务成本叫做Contribution贡献。

④Period cost:当期发生多少减多少。

吸收成本法下包含total non-production cost;

边际成本法下包含total fixed cost

⑤Valuation of closing inventory:Absorption costing > Marginal costing。

吸收成本法存货计价:Direct material+Direct labour+Variable production overhead+Fixedproduction overhead;

边际成本法存货计价:Direct material+Direct labour+Variable production overhead;

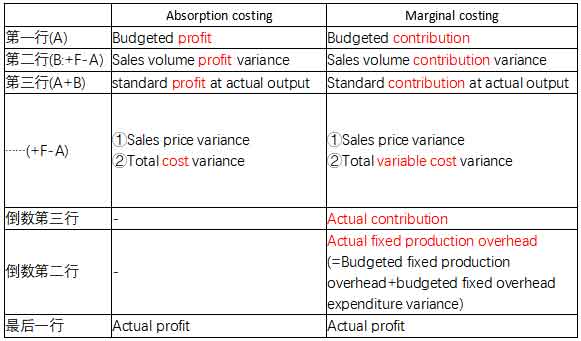

02.标准成本法中的差异

①Cost variance---fixed production overhead variance

Absorption costing:

A.fixed production overhead total variance=under/over absorbed overhead

B.fixed production overhead expenditure variance=budgeted overhead-actual overhead

C.fixed production overhead volume variance=budgeted units*OAR-actual units*OAR

D.fixed production overhead volume efficiency variance=(budgeted hours at actual output-actual hours)*standard production overhead per hour

E.fixed production overhead variance=(budgeted hours-actual hours)*standard production overhead per hour

Marginal costing:(因为MC法下不存在OAR,所以对于fixed production overhead variance只有expenditure variance)

fixed production overhead expenditure variance=budgeted overhead-actual overhead

②Sales variance---sales volume variance

Absorption costing:sales volume profit variance=(budgeted units-actual units)*standardprofit per units

Marginal costing:sales volume profit variance=(budgeted units-actual units)*standardcontribution per units

③Operating statement

利润差公式:MC+OAR*(closing inventory-opening inventory)=AC

注:1.此公式的利润指两种成本核算方法下的净利润,不是contribution和gross profit的比较;

2. Closing inventory-Opening inventory=Production units-Sales units

3. 此公式可以用于求OAR=(AC-MC)/(closing inventory-opening inventory)

以上便是吸收成本法(Absorption costing)和边际成本法(Marginal costing)之间的主要差异和联系了,你记住了吗~

ACCA考试百科

ACCA考试百科

张雪峰深度解读ACCA专业,职业规划与就业前景

张雪峰深度解读ACCA专业,职业规划与就业前景